Private Equity Reporting Group Guidelines

Enhanced Disclosure related to the Guidelines

Vitruvian Partners LLP (“Vitruvian”) is a member of the British Private Equity & Venture Capital Association (the “BVCA”) and as such commits to provide data to the BVCA to enable it to conduct enhanced research into the private equity industry. Vitruvian is pleased to conform on a “comply or explain” basis with the Guidelines. Vitruvian also seeks to promote conformity with the Guidelines, where relevant, on the part of any portfolio companies which fall within the scope of the Guidelines.

Leadership and History of Vitruvian

Founded in 2006, Vitruvian specialises in making control-centric investments in higher growth, middle-market companies, predominantly across the EMEA region. Vitruvian is principally based in London, but with offices in Munich, Stockholm, Luxembourg, Shanghai and San Francisco. Vitruvian is controlled and owned by its partners, promoting strong alignment of interest with its Limited Partners and investment outcomes. Vitruvian focuses on Dynamic Situations, for which it has raised five funds to date, characterised by high growth and change across asset-light industries. Vitruvian Funds have backed over 50 companies and have assets under management of c.€10 billion. Vitruvian is a member of the BVCA and a signatory of the Principles for Responsible Investment (“PRI”). Please refer to the About Us section of the Vitruvian website for further information.

Structure of Vitruvian

Vitruvian is authorised and regulated in the United Kingdom by the Financial Conduct Authority. Vitruvian currently manages five private equity funds structured as limited partnerships, known as Vitruvian Investment Partnership, I, Vitruvian Investment Partnership II, Vitruvian Investment Partnership III, Vitruvian Investment Partnership I CF, and Vitruvian Investment Partnership IV (the “Vitruvian Funds”).

Vitruvian Funds are closed ended with a typical fixed term life of ten years (subject to extensions). Investments are typically made in the first five years of a fund’s life, held for a number of years and divested prior to the end of the fixed term.

Vitruvian’s Investor Base

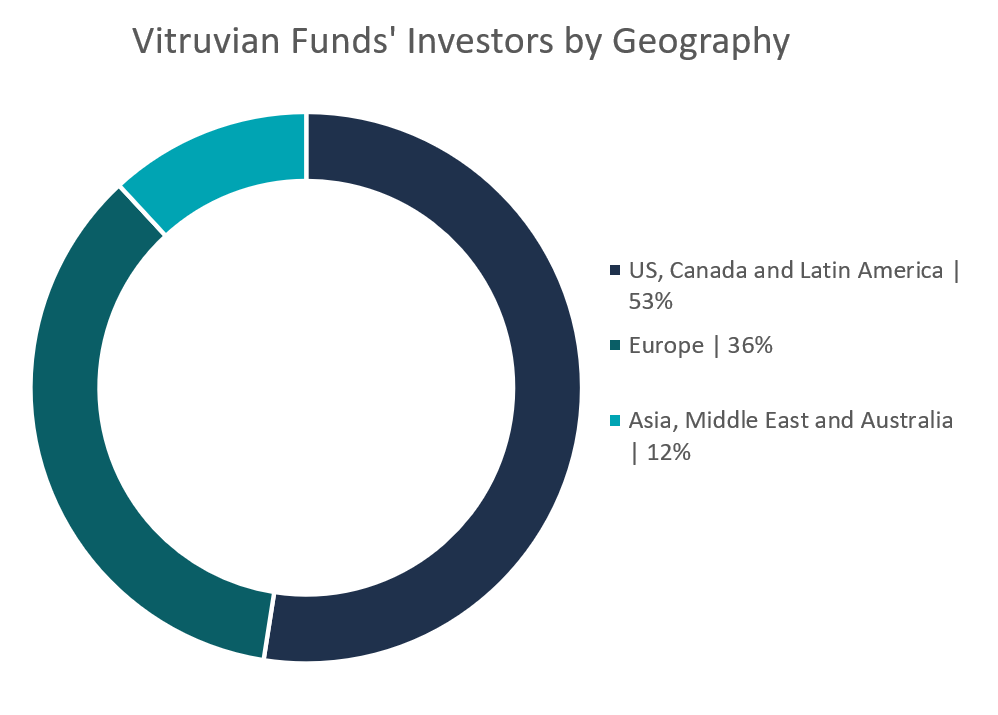

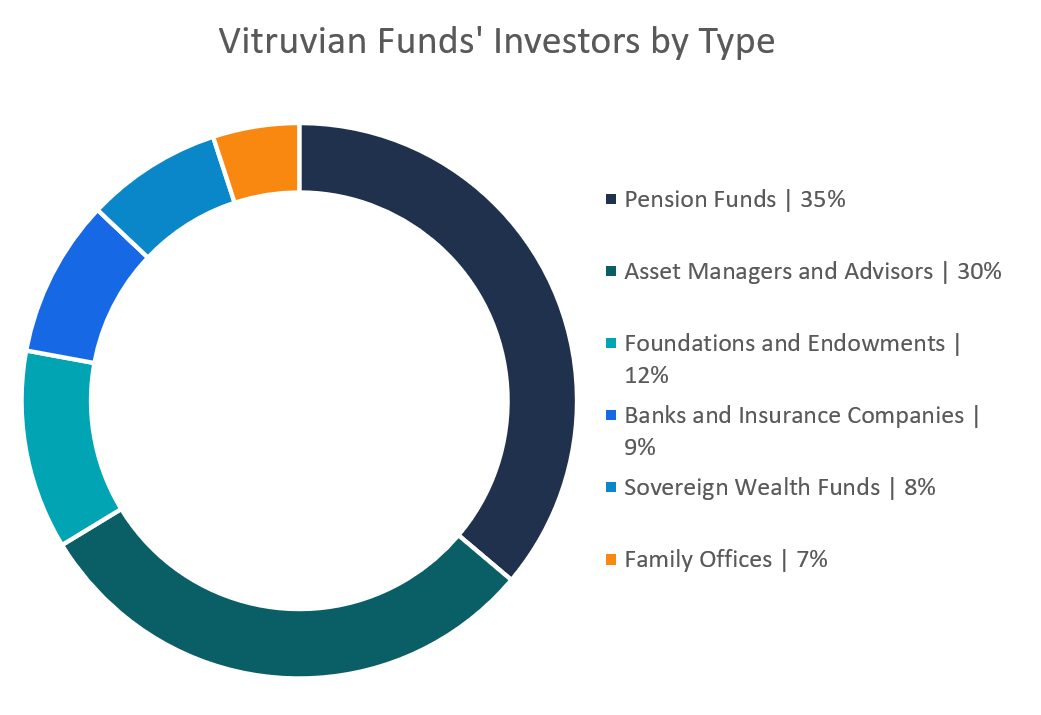

The charts below provide an overview of the composition of the overall investor base across the Vitruvian Funds (excluding commitments by the general partners and other Vitruvian affiliates).

Note: As at 31 March 2022

Investments in UK-based companies

The following UK portfolio companies held by Vitruvian Funds currently fall within scope under the Guidelines:

- Sykes Cottages

Conflicts of Interest

Vitruvian has in place detailed policies and procedures which govern the way it operates. This includes an established Conflicts of Interest Policy, which sets out the process for managing actual and perceived conflicts of interest as they may arise in relation to both Vitruvian and Vitruvian Funds. All Compliance Policies and Procedures are monitored by the firm’s Chief Compliance Officer and relevant Vitruvian committees. Any conflicts which may arise between Vitruvian and a Vitruvian Fund are managed in accordance with both applicable legal and regulatory requirements and documentation relating to that fund.